Do you have a plan for retaining your independence as you age?

We all look forward to the freedom that comes with getting older. The anticipation starts when we’re young and we dream of being “old enough” to do fun things. Our dreams of freedom change as we grow older — first sleepover, first driving lesson, first kiss.

These rights of passage that come with age are celebrated. But, eventually, we realize how complicated aging can be. Responsibilities, commitments, and of course, insurance to help cover the unexpected and necessary expenses that we all endure.

There’s a policy for everything.

Your car, your house, your life, your death… the list goes on. If it involves a major expense, there’s an insurance policy to cover it and making the right decisions is difficult.

Long-Term Care policies exist to help you cover the costs associated with needing long-term care for you or a loved one in your lifetimes. Just like with other policies, some things are covered, some things aren’t, and finding the right one for you can be hard.

While we’re not in the insurance industry, it is our job to help you find the right resources to help you make the best decisions for your unique circumstances. We’ve learned a thing or two throughout years helping hundreds of people just like you and we’re happy to share those insights with you.

Long-Term Care Policies: What You Need to Know

If you’re considering investing in long-term care, you have a lot to learn first. From the essentials facts to understanding your options, we’re going to make sure you have all the information you need to make an informed decision. So, let’s dive in!

Understand the Basics of Long-Term Care Policies

A long-term care insurance policy is a policy that’s designed to cover some of the costs associated with your care when you have a chronic medical condition, disability, or disorder.

Why do people buy them?

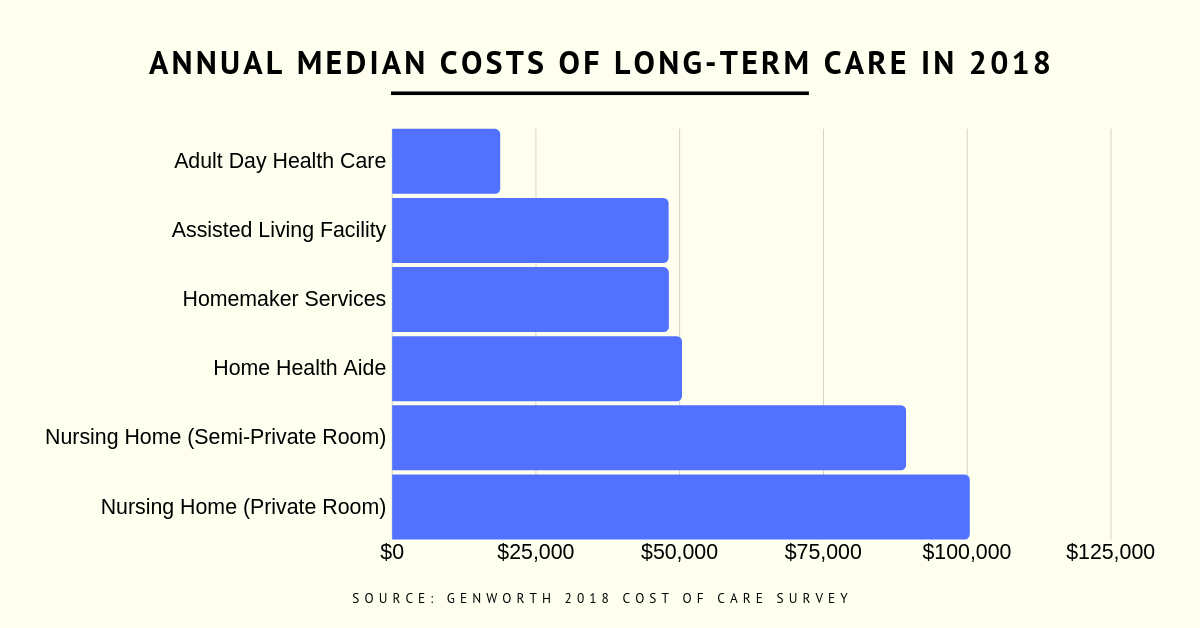

The answer is simple — long-term care is expensive. The median cost of care in a semi-private nursing home is $89,297 a year, according to Genworth’s 2018 Cost of Care Survey.

Most people will quickly deplete the hard-won nest egg at those rates. They will also have to make compromises in the type of care they receive to be able to afford it.

For example, if your savings is only $200,000, you would have enough to last for two years in a nursing home with a private room and just over ten years in an adult daycare facility.

Long-term care policies are designed to help you stretch your savings out further by covering some or all of your costs associated with care and allowing you more options for care.

How does long-term care insurance work?

Like most other insurance policies, you talk to a provider, share some information, and (hopefully) get approved for a policy. You dutifully pay your premiums to keep your policy active.

Most policies will consider you eligible for benefits when you are no longer able to do two out of six “activities of daily living” (ADLs) without assistance. They also may deem you eligible if you suffer from diseases or conditions that cause cognitive impairment like dementia.

Activities of Daily Living include:

- Bathing yourself.

- Caring for your incontinence.

- Getting dressed by yourself.

- Feeding yourself.

- Getting on or off the toilet (toileting).

- Getting in and out of bed or a chair (transferring).

When you reach a stage where you need care, your insurance company will review documents from your doctor and may additionally decide to send a nurse to do an independent evaluation. They will also require you to have a “plan of care” in place.

It is typical for policies to have a daily limit that they will pay for care as well as a lifetime maximum. There are some policies that have a “shared care” option that will allow you to share coverage with your spouse. You can draw from your spouse’s benefit pool if you reach the limit on your own policy.

The Elimination Period

Most policies will require you to pay for your own care-related services for a set amount of time — such as 30, 60, or 90 days — before they will start reimbursing you for your care.

Know Your Options

What are the alternatives to long-term care insurance? Before you invest in a long-term care policy, you should be aware of your other options and plan ahead.

Medical Insurance

If you are still actively employed when you need long-term care, then your company insurance policy may cover your care. It’s typical for employer group plans to over 30 to 60 days of skill care after a hospital stay and some plans will even cover a similar number of days of home health visits. Talk to your HR department to find out what your coverage includes.

Disability Insurance

If you are actively employed, then utilizing your employer’s group disability plan may be an option. Disability insurance is designed to help reimburse you for the income lost while you are unable to work. The funds can be used for things like your mortgage, food, and bills, but it can also be used to pay for healthcare expenses.

Medicare

If you’re over the age of 65 and on Medicare, then some intermittent, part-time home health visits may be covered — however, there may be restrictions on coverage such as only being eligible if you are also getting skilled care such as nursing or physical therapy. Your eligibility will be reevaluated every 60 days, so you will need to continuously prove that you need care.

Medicaid

Medicaid is only intended for use by people that are blind, disabled, or elderly that have limited income and assets. If your total assets are below $2,000, then it’s likely that you’ll qualify for financial assistance for any form of custodial care. You can check with your county’s Department of Social Services to find out specific eligibility requirements and benefits.

Why should you consider other options?

In some cases, you may not have a choice. If you already are in a situation where you need long-term care, then you won’t qualify for insurance and will need to explore other avenues to get assistance with your expenses.

Likewise, you may simply not qualify for insurance policies. Each provider will have their own criteria that they use to evaluate your eligibility. If you don’t pass their criteria, you won’t be insured.

How do you decide which option to choose? Make sure that you do your research.

- Learn about long-term policies and the costs and benefits associated with them.

- If you’re employed, talk with your employer about options provided under your health plan with them.

- Become familiar with your state’s Medicare and Medicaid plans and what is covered.

- Investigate care options to determine what you would feel most comfortable with and what the costs are associated with it.

Choose the Right Long-Term Care Policy

What factors should you consider?

Choosing the right policy for you can be a complicated decision — and one that you should make sooner rather than later. Your eligibility for benefits will only decrease as you age and your likelihood for needing care increases.

Consider these factors when you are doing your research:

Why those factors are important?

Like most major purchases in your lifetime, it’s important to know what you’re buying before you sign and commit.

Your eligibility for policies and specific benefits will only decrease as you age. This means that it will be harder and harder to change your mind and go with a different provider later.

So do your homework upfront and make the best decision initially.

Find the Right Professional Advocates

If you have the right people in your corner helping you make hard decisions, you can be free to enjoy your life instead of being weighed down by paperwork. If you are feeling the stress and pressure, then it might be time to consider bringing in a Professional Care Manager.

What is a Professional Care Manager?

Professional Care Managers are specially-trained professionals that act as a sort of “professional relative” for you as you age and need help. They work with you to help you research and make the best decisions for your needs and the needs of your loved ones.

Why is a Professional Care Manager a good person to have?

Professional Care Managers have a lot of experience with aging and everything that comes with it. From legal and healthcare hurdles to emotional concerns, they can help you navigate hard times and tough decisions.

They are especially helpful in situations where you have little to no family and friend support. If your family lives far away or has already passed, they can fill in that gap and provide someone close by to call on or act as your emergency contact.

They can also act as a neutral third-party to help you work through difficult decisions that you don’t want to place on your loved ones.

How do you find a Professional Care Manager?

The easiest way to find a qualified and experienced Professional Care Manager is to seek out an organization like Aging Life Care Association or Eldercare Locator.

They will help you find and choose the best Professional Care Manager with experience in your specific situation.

Keep Learning & Make Informed Decisions

Things like long-term care policies are only one of many decisions that you’ll need to make in the coming years.

Your future may be unpredictable, but you don’t have to face it unprepared.

We add new content to our blog every month to help people just like you navigate large and small decisions that come with aging. Make sure that you don’t miss out — subscribe to our newsletter and we’ll send you an email each time we publish a new article.

Get Our Newsletter

Navigating life after 50 can be complex for you and your loved ones. We're here to help with tips, advice, and answers to questions. When you sign up for our newsletter, we'll let you know by email when we publish new articles that can help you.